Electric Scale Vehicle Tax

Electric Scale Vehicle Tax. You can enter your registration number and get the details of. On the gst front, the gst rate of electric vehicles was reduced from 12% to 5% w.e.f.

Come 2025 there will be a standard rate of road tax to pay, and an added surcharge to vehicles. The current 2024 benefit in kind (bik) rate in the uk is 2% for electric cars.

On The Gst Front, The Gst Rate Of Electric Vehicles Was Reduced From 12% To 5% W.e.f.

Gst rate to benefit ev purchasers, the government has reduced the gst rate for evs from 12% to 5.

This Reduction Aims To Make Evs More Affordable For The Average Consumer, Thereby.

The government of india has also reduced the gst on electric vehicles from 12% to 5%.

There's Currently No Road Tax At All On Electric Cars In The Uk.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, You can enter your registration number and get the details of. For example, maharashtra has granted subsidy on road tax on electric cars up to rs 1.5 lakh.

Source: palmetto.com

Source: palmetto.com

Electric Vehicle Tax Credit Guide 2023 Update), On electric automobiles and suvs, maharashtra offers a maximum subsidy of rs 2.5 lakh, while delhi, gujarat, assam, bihar, and west bengal offer maximum subsidies of rs 1.5 lakh. You get a deduction of rs.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What, The current 2024 benefit in kind (bik) rate in the uk is 2% for electric cars. This reduction aims to make evs more affordable for the average consumer, thereby.

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, Kentucky will impose a tax of $0.03 per kilowatt hour on electric. The government of india has also reduced the gst on electric vehicles from 12% to 5%.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

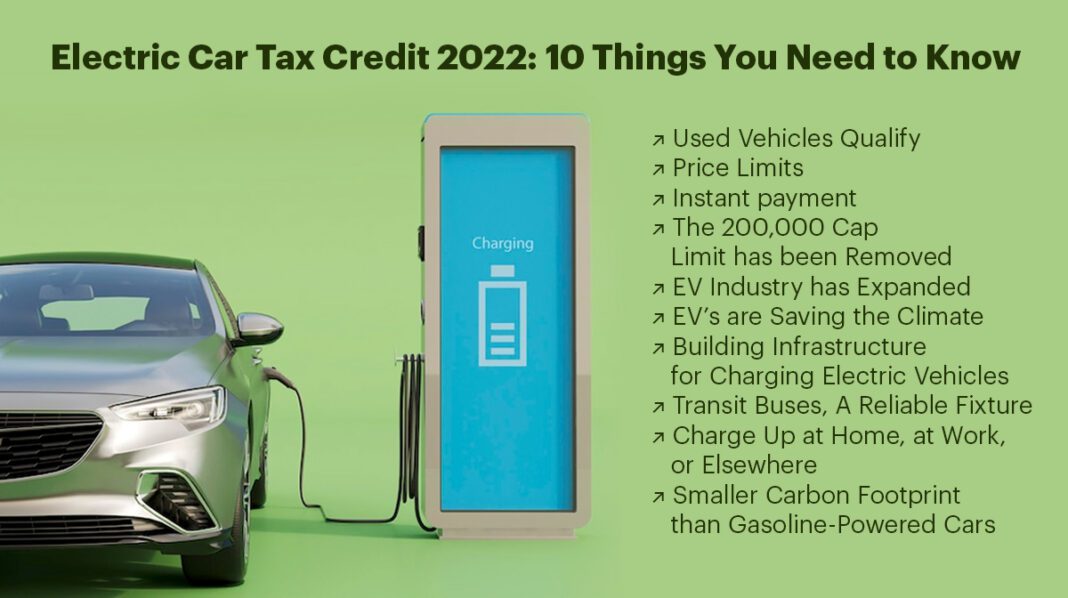

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, The following are some of the tax benefits of electric vehicles: The current 2024 benefit in kind (bik) rate in the uk is 2% for electric cars.

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, Following transactions are pending at bank side. Come 2025 there will be a standard rate of road tax to pay, and an added surcharge to vehicles.

Source: www.clm.co.uk

Source: www.clm.co.uk

A Guide to Company Car Tax for Electric Cars CLM, The government of india has also reduced the gst on electric vehicles from 12% to 5%. Parivahan sewa know your mv tax is a service that allows you to check the tax status of your motor vehicle online.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, Select the state where your vehicle is registered. The following are some of the tax benefits of electric vehicles:

Source: www.autopromag.com

Source: www.autopromag.com

Here are the cars eligible for the 7,500 EV tax credit in the, You get a deduction of rs. 1,50,000 under section 80eeb on the interest paid on loan taken to buy electric vehicles.

Source: benefitsfinder.com

Source: benefitsfinder.com

2023 Electric Vehicle Tax Credit, The companies will be allowed to import a maximum of 40,000 electric vehicles, at a rate of 8,000 cars per year, at a 15 percent duty. There's currently no road tax at all on electric cars in the uk.

The Current 2024 Benefit In Kind (Bik) Rate In The Uk Is 2% For Electric Cars.

Additionally, individuals are allowed an additional deduction of rs 1.5.

Parivahan Sewa Know Your Mv Tax Is A Service That Allows You To Check The Tax Status Of Your Motor Vehicle Online.

This reduction aims to make evs more affordable for the average consumer, thereby.